Residentaial Conveyancing Solicitors

Conveyancing

Conveyancing is the legal process of transferring property or land from the seller to the buyer. Property law is complex and requires expertise and experience to make the process as easy as possible. Our conveyancing team at Wade & Davies have many years of experience in all aspects of property law. We can assist with:

- Sales and purchases of residential properties

- Sales and purchase of commercial premises

- Sales and purchases of freehold and leasehold properties, including shared ownership schemes, flats and apartments

- Remortgages, including buy to let mortgages

- Lease extensions

- Equity release

- Gifts and transfer of equity

- Tenancy agreements

- Deeds Registration

- Buying and selling at auction

Moving house is considered to be one of the most stressful things to do, especially when there could be problems in the chain, disagreements between buyer and seller, problems highlighted in the survey. That is why having experienced conveyancers is essential to reduce that stress and ensure the transaction completes as smoothly as possible.

Wade & Davies have been helping people with property transactions for over 250 years and you will be looked after by one conveyancer, rather than a ‘team’ of conveyancers or a ‘case handler’, so that you get a full personal service, which makes the process quicker when you have direct access to your own conveyancer who knows your file inside and out.

We are acknowledged for our continual high standards and level of service by the Law Society accreditation with the Conveyancing Quality Scheme.

We are fortunate to have received many recommendations and repeat instructions over the many years our solicitors have been in practice. This is a testament to the pride we take in our work and the quality of the service our clients receive. We do not pay for estate agents’ referrals and can therefore be completely independent with only our client’s best interests to consider.

Residential Conveyancing

Legal Fees for typical Residential Property Sale and Purchase

At Wade & Davies, we pride ourselves on the fact that our fees cover all the work required to complete the purchase of your new home, including dealing with registration at the Land Registry and dealing with the payment of Stamp Duty Land Tax (Stamp Duty). It also includes us acting for your Lender. There are no hidden charges on top of our fees for carrying out the above services. VAT on our fee is currently charged at a rate of 20%. Disbursements are costs related to your matter that are payable to third parties, such as Land Registry fees. We will deal with the payment of the disbursements on your behalf to ensure a smoother process.

Purchase

Conveyancer’s fees and disbursements

Please complete the enquiry form for a tailored quotation. Please include whether you require a mortgage and whether you are a first-time buyer. The costs quotation is based on the purchase price

In addition of our fees for acting on your behalf, there are disbursements which you will also need to meet the cost of.

There are fees for HMRC, please see below. There are no additional fees or VAT on disbursements.

HM Land Registry fee – dependent on purchase price

- · HM Land Registry Priority search fee £7

- · HM Land Registry Bankruptcy Search fee £3.00 per purchaser

- · Telegraphic bank transfer fee £33 (including VAT)

Searches

The searches we routinely commission include a local authority search, water and drainage search, environmental search and chancel repair search. If you are having a Lender, these are the minimum search bundle that you will be required to have. If you are not having a Lender and do not feel that a flood search is appropriate on say a 3rd floor flat, then that is something that we will discuss when we are ready to submit searches.

Sometimes, if you are purchasing in a different area, further searches may be required and when these are advisable, we will inform you of the total cost of the search before commissioning the searches. Searches are usually between £300 and £450 depending on the location of the property.

Stamp Duty Land Tax (on purchase)

Land Registry Fees

Leasehold Property Purchase Fees

In leasehold purchases, there are usually further payments to third parties such as a landlord/managing agent that we make for you. These can include:

• Notice of Transfer fee – This fee if chargeable is set out in the leasehold information. Often the fee is between £35- £125.

• Notice of Charge fee (if you are having a mortgage) – This fee is set out in the leasehold information. Often the fee is between £35 and £125.

• Deed of Covenant fee – This fee is provided by the management company for the property and can be difficult to estimate. Often it is between £150 and £300.

• Certificate of Compliance fee – This is set out in the leasehold information and can range between £50 – £150.

You should also be aware that ground rent and service charge are likely to apply throughout your ownership of the property. We will confirm the ground rent and the anticipated service charge as soon as we receive this information.

Sale

Our charges cover all the work needed to complete the sale of your home. There are no searches involved in the sale side of a property transaction. Please email us or complete the enquiry section to obtain a no obligation quotation.

Client fees and costs are made up of:

Our Legal fee: please contact us for a detailed quotation

- 20% VAT payable on legal fee

- Telegraphic transfer fee (if applicable): £33

- Land Registry fee – £14 title and plan, £7 for each additional document needed.

Please note that sellers of leasehold properties will also need to obtain a ‘Seller Management Pack’ from the Management

How long will my freehold house purchase take?

The average conveyancing process takes between 8-12 weeks. There are lots of variables on this timescale and a lot depends on the rest of the chain moving at the same time as your transaction. Most leasehold transactions take longer, regardless of where they are in the chain. There is usually a delay in the seller obtaining the leasehold pack from the management company. At Wade & Davies, we are aware of the delay that this causes to everyone else and we look to combat that by having early access to the freeholder information to apply for the paperwork, to try to alleviate the delay as much as possible. However, if you are buying a leasehold property that requires an extension of the lease at the same time, this can take significantly longer and this can depend on the Landlord and the Seller. In such, a situation additional fees plus VAT may apply to both the Landlord and their solicitors. Please contact Wade & Davies as soon as possible if you think that there could be a delay for any of these reasons, and we will do everything that we can to ensure that as much as possible is done to alleviate any delay caused by these issues.

Stages of the Conveyancing Procedure for a Purchase

There are different stages involved in the purchase of a residential property. They will vary according to the circumstances. However, below we have set out some key stages that you may wish to include:

- Take your instructions and give you initial advice

- Check finances are in place to fund purchase

- Receive and advise on contract documents

- Carry out searches

- Obtain further planning documentation if required

- Make any necessary enquiries of seller’s solicitor

- Give you advice on all documents and information received

- Go through conditions of your mortgage offer with you

- Send final contract to you for signature

- Agree completion date

- Exchange contracts and notify you that this has happened

- Arrange for all monies needed to be received from lender and you

- Complete purchase

- Deal with payment of Stamp Duty Land Tax

- Deal with application for registration at HM Land Registry

Stages of the Conveyancing Process for a Sale

Key stages in the sale process include:

- We take your instructions and give you initial advice

- Once you have provisionally accepted an offer, we check the buyer’s finances are in place to fund their purchase, and contact their solicitors if needed

- We draw up draft contract documents and send them to the buyer’s solicitor

- We respond to any enquiries from the buyer’s solicitor and supply and documentation they may require

- Once the buyer’s solicitor is happy to proceed, we send the final contract to you to sign

- We agree the completion date with the buyer’s solicitors

- We exchange contracts and notify you once this has happened

- We arrange for your legal fees to be received

- We legally formalise the completion of your sale

- We receive the agreed purchase price from the seller’s solicitor and pay it on to you after deduction of your legal fees

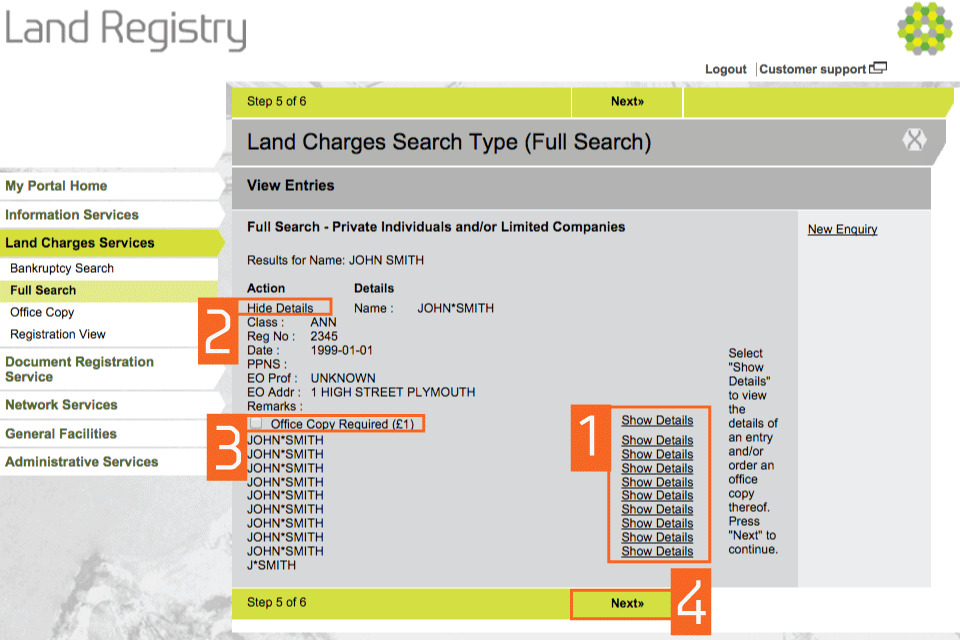

Registering Title Deeds

Wade & Davies conveyancers are specialised in registering title deeds with the Land Registry, including any application for possessory title. The Land Registry is a department of the UK government which records property ownership in a digital register. From 1990, all property transfers need to be registered, whether it is gifted, bought, transferred or mortgaged.

It is important to register your title deeds. There is no back up records which contain evidence of your ownership. If your deeds are lost or damaged, this can cause difficulties in registering your property in any future sale. This would make the process of selling at a later date more delayed and costly. Some conveyancers now insist of having the property registered at the Land Registry, before they will proceed with a purchase. This again can cause delay.

If you decide to voluntarily register your deeds, we at Wade & Davies will securely hold your deeds and make the application on your behalf. There are further benefits to registering your title deeds. The Land Registry offer a discounted rate for voluntary applications. By registering your deeds, you are protecting yourself from the risk of fraud that can occur from copying or withholding your deeds and it also makes any subsequent sale easier and more straightforward.

Gifts and Transfers of Equity

Transferring equity in a property requires either adding a name or removing a name from the title deeds of a property. It is a reasonably straightforward transaction provided that all parties, including any Lender, agree. Gifting property is where property is transferred to another person without payment. Stamp Duty Land Tax will sometimes be payable to HM Revenue and Customs. A transfer of equity takes between two to three weeks to complete (unless a mortgage offer is required and then it may take longer).

Buying and Selling at Auction

Buying at Auction

The main difference between purchasing a property at auction and through the standard channels, is that the contract has effectively exchanged at the drop of the hammer. Therefore, it is imperative that the legal pack is obtained and forward to a conveyancer as early as possible before the auction date, to avoid any nasty shocks after the auction concludes. Some properties are in auction due to complications or issues that may prevent a sale through estate agents. If you withdraw from the purchase after the auction, it will cost you the deposit potentially. We at Wade & Davies are specialists in the auction process and can provide quick and reliable advice and reports within a short period of time prior to the auction date.

Selling at Auction

Wade & Davies have seen an increase in the sale of property at auction in and around Dunmow over recent years. We are experienced in preparing auction packs and you should start the legal process as soon as you decide to sell your property at auction. An auction pack is comprehensive and also requires the submission of searches at the earliest stage to avoid delays later on. Furthermore, there may be restrictions or covenants on the title which may make the property seem less desirable. As part of the conveyancing process, Wade & Davies are specialists in dealing with the Land Registry and if necessary, can make applications to remove redundant restrictions, or provide indemnity insurances, to counteract any issues that may be evidence on the title, to ensure a smooth process and the highest possible price for the property. Once the pack is prepared, we send the comprehensive auction pack to the auctioneers, where it will be uploaded for potential bidders. Please contact us for a quotation and discuss further.

Remortgaging

At Wade & Davies, you can rest assured that your remortgaging transaction will be in the hands of property professionals who can see the matter through from start to finish, liaising with any mortgage broker and the Lender on your behalf to complete the transaction as smoothly as possible.

We provide clear communication and guidance. Your questions will be answered, your concerns addressed, and your journey made smoother by our dedicated expert property team.

To request a remortgage quotation please use the enquiry form or telephone us on 01371 872816 or email at enquiries@wadeanddavies.co.uk

Equity Release

Many people find Equity Release or Lifetime Mortgages an effective way of generating readily accessible capital from the equity in their home. Equity Release means releasing some of the value of a property while continuing to enjoy the use of the property. There are many reasons why people do this:

- When you are retired and own your home you may wish to supplement your pension to meet your costs of living, by releasing some equity from the value of your home over many years so that you have more money to live off in your retirement.

- It maybe you are faced with a major cost, such as a family wedding, children’s higher education, or private medical treatment. Equity release can free up the funds you need to pay for it

- To fund a holiday or to carry out home improvements

Wade & Davies are available to provide you with the best legal advice and assistance when considering or entering any equity release or lifetime mortgage schemes.